This represents the data building blocks which permit continuous processing of 24hr financial trading activities.

Deployment across different entities, time zones, financial products and roles, with one installation.

No constraints regarding the internal organisation of the financial institution.

Front office and processing independent from several official P&L closings.

For a single entity organisation, the structure of the building blocks and organisation of official closings is fairly simple. At one point during the day all books are closed, reference market data is snapped at local closing time and the official P&L is calculated on a trade by trade basis for all open positions.

Multi−entity, multi−geographical, multi−time−zoneorganisation, the scenario can be more complex. Different entities can process their own trades and use local market data.The desks are closed independently for each entity and the FO date rolled forward separately for each entity. Once all regions have closed, the Processing date is rolled.

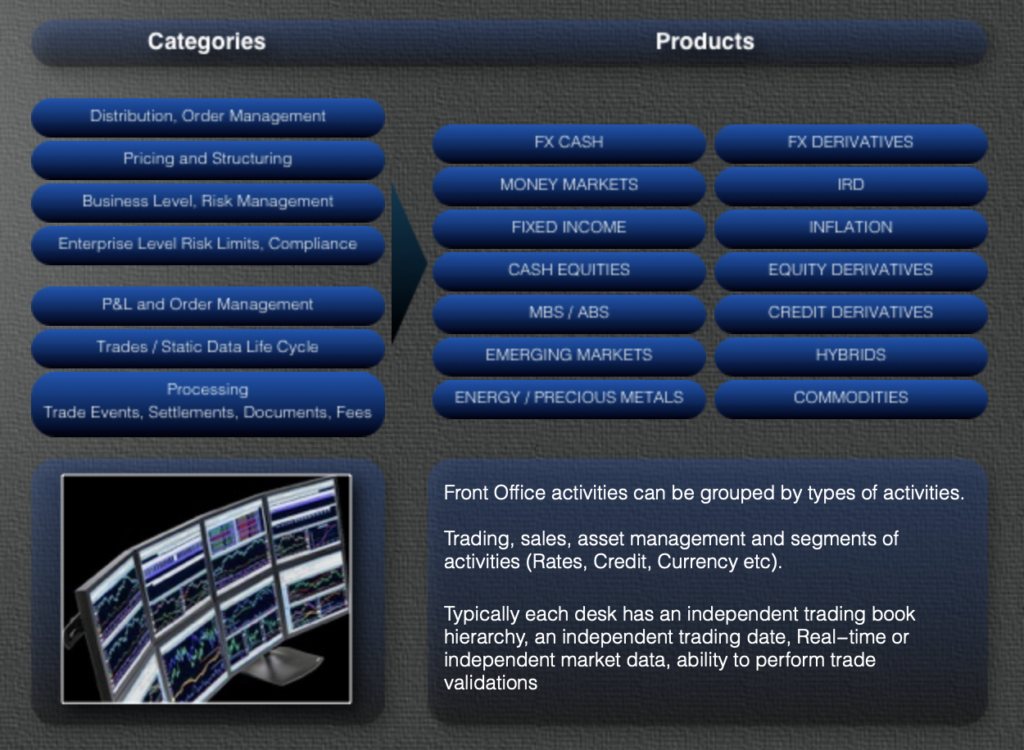

Front Office activities can be grouped by types of activities.

Trading, sales, asset management and segments of activities (Rates, Credit, Currency etc). Typically each desk has an independent trading book hierarchy, an independent trading date, Real−time or independent market data, ability to perform trade validations. https://valkeris.com/the-trade-life-cycle-explained/