Financial technology – The ‘FinTech’ abbreviation describes the evolving intersection of financial services and technology.

- Fintech can refer to startups, technology companies, or even legacy providers. The lines are blurring, and it’s getting harder to know where technology ends and financial services begin.

- Startups use technology to offer existing financial services at lower costs, and to offer new tech-driven solutions. Incumbent financial firms look to acquire or work with startups to drive innovation. Technology companies provide payment tools. These can all be seen as FinTech.

Look beyond the name and you will see some of the most exciting industry developments in a generation.

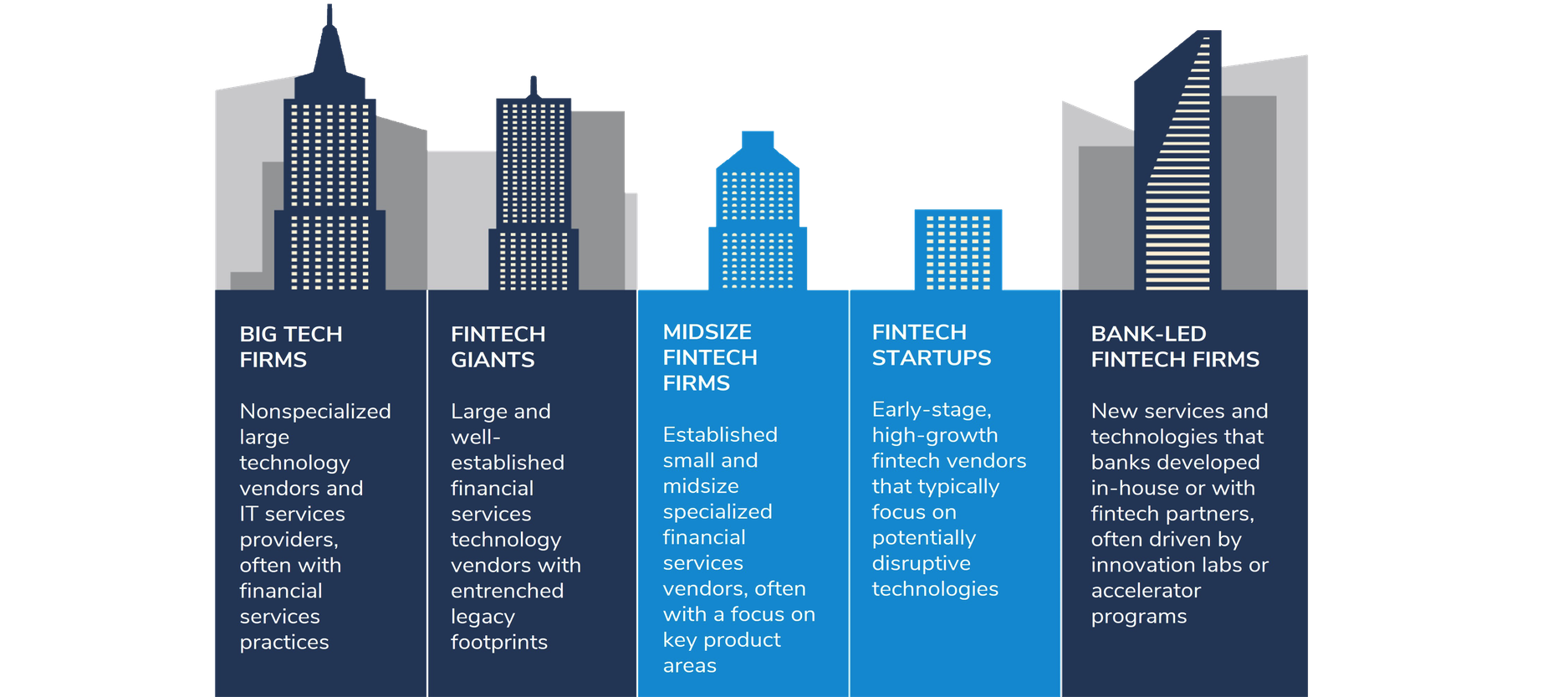

When people think of FinTech, they often focus on startups, breaking into areas which banks and other legacy financial institutions have dominated. But we think about all the players in a larger FinTech ecosystem

FinTech disruptors started by offering products and services in payments and peer- to-peer lending. Because of this, these have been the most disrupted areas to date. We can think of this as “FinTech 1.0,” in which new market entrants have focused largely in the business to consumer (B2C) space. We expect FinTech disruptors to continue to expand into other areas within financial services. There’s a lot of interest in areas like marketplace lending, credit underwriting, digital cash, treasury functions, deposits, bill payments and wealth management

A lot of FinTech innovation in the next 12 months will be in the business-to-business (B2B) space. You can think of this as “FinTech 2.0.” Expect tech innovations like blockchain to come on line. As they do, they’ll start to radically alter business processes and drive down costs. We’re already witnessing a lot of firms exploring how they can apply these breakthrough technologies

This is the new normal, hence over the long-term, financial institutions will need to make fundamental changes.

- Peer-to-Peer (P-2-P) lending:

Peer-to-Peer lending has become widely popular over the last few years through providing an alternative way to get a loan.

- Crowdfunding:

Similar to P-2-P, Crowdfunding emerged as a much needed alternative method of obtaining funds for start-ups as the banks scaled back their lending scope.

- Mobile Payment Apps:

In an increasingly tech-savvy world where consumers demand instant and interactive access to all products, mobile payments have rocketed in popularity; mobile payment volumes in 2015 were reported to be worth $450bn USD and this is predicted to reach to $1 trillion USD in 2019.

- (FX) Foreign Exchange platforms:

FX services that are far more responsive can be delivered via fintech firms enabling No Dealing Desk (NDD) execution of trades with no spread involved.

- Trading Platforms:

Trading Platforms are becoming increasingly popular to both retail and institutional investors. These platforms open the opportunity for investing to a far wider audience through lower fees and instant access.