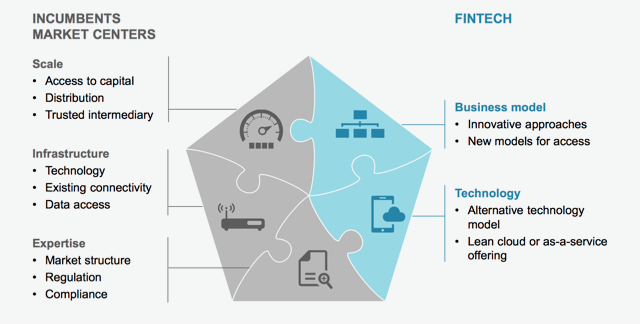

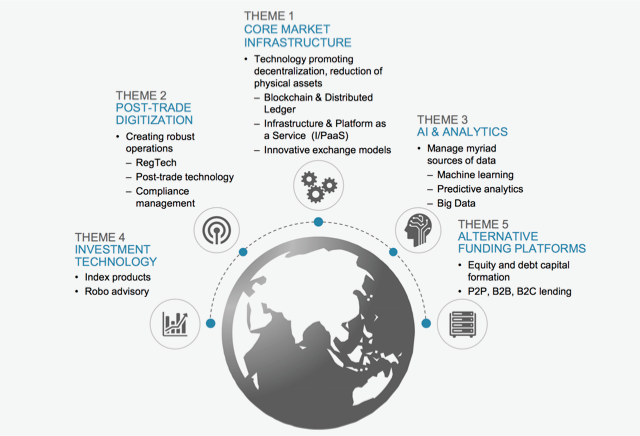

Solutions that address critical points around market infrastructure, post-trade processes.

Market Infrastructure

Creating more transparent access to liquidity.Developing efficient and intelligent platforms for trading and clearing. Creating and expanding new asset classes. Leveraging new technologies in the cloud and API interactivity in order to seamlessly manage market infrastructure or connectivity as a service.

-

Post-Trade Digitization: Automating the heavily manual processes that still exist within the compliance, regulatory, collateral management, and securities lending; increasing capital efficiencies, clearing and settlement businesses; and launching innovative solutions to manage enterprisewide stress testing, risk attribution, and reporting processes.

-

AI & Analytics: Developing solutions that that utilize in-memory computing and machine learning to leverage the massive swell of structured and unstructured data to make predictions, and build analytics at the point of trade.

Similarly, innovation is changing the way investment and funding is provided and consumed:

-

Investment Technology Digitization: Software and tools that enhance investment decision-making, as well as contribute to accelerate the shift towards passive investments.

-

Alternative Funding Platforms: Platforms that allow alternative models for capital formation across the capital structure of both large institutions and SMEs.